ATLANTA — A massive transportation funding bill that will affect counties throughout the state has reached Gov. Nathan Deal’s desk after it passed in the last few days of the Georgia General Assembly’s 2015 session.

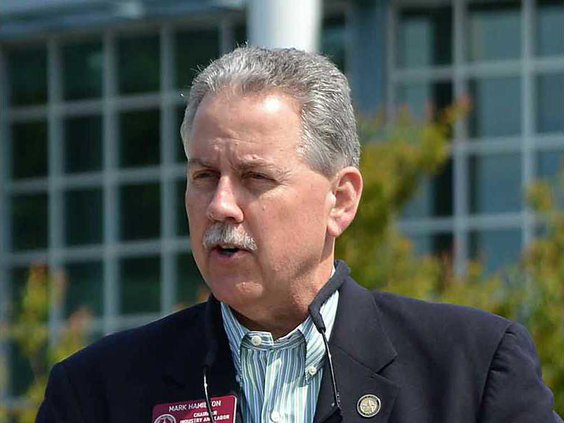

Cumming lawmaker views state transportation bill as great step